Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100, with high levels indicating the instrument is overbought and vice versa. When RSI indicates an overbought situation and it starts to turn down, that indicates a loss of momentum, which may foretell a trend change. RSI has two major weaknesses that limit its usefulness:

- The indicator directly reflects the noise of the market, so in a noisy market, it takes on a jagged appearance and may generate many false signals.

- It has a length setting which is somewhat arbitrary. Longer-period RSIs will be smoother, but lag the market significantly. Shorter-period RSIs will be more responsive to trend changes, but as per the previous point, generate more false signals.

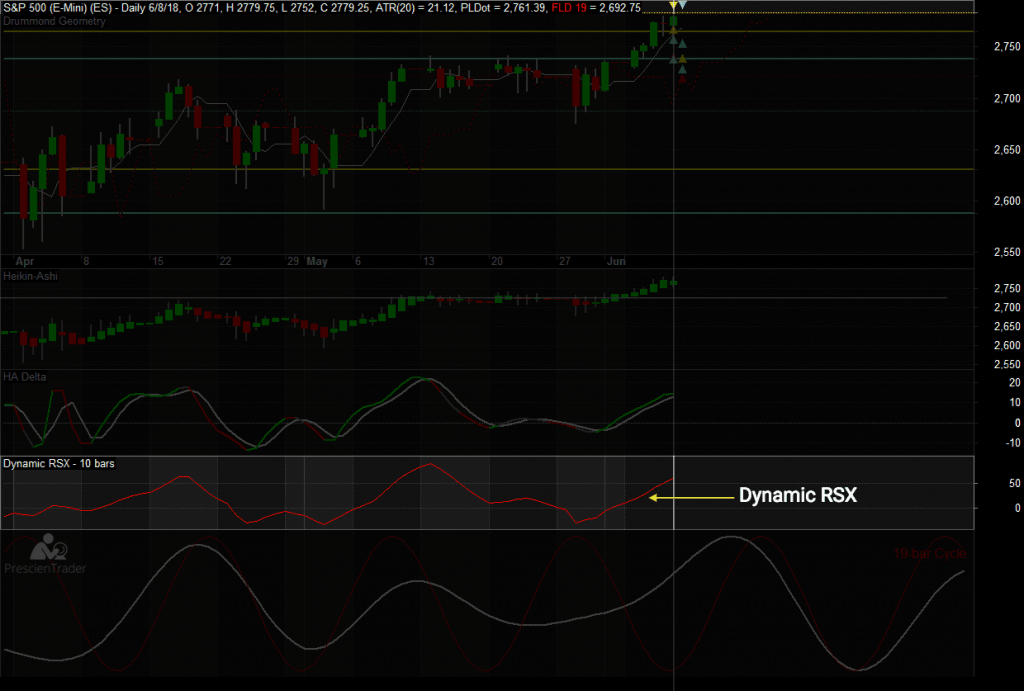

The challenge then, is to smooth the indicator without substantially reducing its responsiveness and to adjust its length setting to reflect the cyclical behavior of the market. On our charts, we display an enhanced version of RSI called RSX. RSX was invented by Mark Jurik of [thirstylink ids=”6184″]Jurik Research[/thirstylink] and it uses Jurik’s advanced smoothing algorithms to achieve the first goal, smoothing the indicator without introducing excessive lag. This is a big improvement, but we improve it further by dynamically adjusting its length to half that of the fastest active cycle frequency. We borrowed this idea from Lars von Thienen of [thirstylink ids=”6158″]WhenToTrade.com[/thirstylink].

By tuning RSX to the market cycle, we end up with an indicator that’s both smooth and incredibly responsive to the current market condition. When the cycle frequency increases in speed, we adjust the RSX length down, because we anticipate frequent trend changes. When the cycle frequency slows down, we increase the RSX length, because we expect less frequent trend changes. Thus, when RSX is at an extreme high level and it starts to turn down, we can be confident that it’s in tune with the market cycle and likely predicting an actual trend change rather than a false signal.